The Case for Automotive Program Management

APM

An Automotive Program Management (APM) System is a purpose-built software system of reference designed to coordinate the people and information needed to manage the auto component manufacturing program lifecycle.

No manufacturing sector is as complex or as valuable as the auto industry. Manufacturers across more than 100 countries collaborate to produce the most advanced consumer products. The volume of production is staggering, and the expectation is perfection.

Viewed from a distance, the auto industry is an operational marvel. A product of sophisticated design, engineering, and manufacturing technology. But zoom in, and there is a surprising vulnerability at the most critical point in the supply chain.

It has been decades since the industry transitioned from vertically integrated manufacturing to outsourced. Automakers today rely on a global network of specialized suppliers making everything from body panels to suspension parts, from seats to electrical components, and the thousands of parts that are assembled into finished vehicles. While nuts and bolts and connectors are typically standard, off-the-shelf items, most top-tier suppliers (those at the top of the supply chain who supply the automakers and assembly plants directly) are providing custom parts for specific automakers.

At the most critical point in the supply chain – the connection from automakers to their direct suppliers – a place where logic dictates a high level of operational sophistication, instead we find manual effort, spreadsheets, and staff working at their breaking point. It is a problem that has persisted for years, but trends now sweeping the industry suggest that it’s about to become a crisis.

The OEM/Supplier Relationship

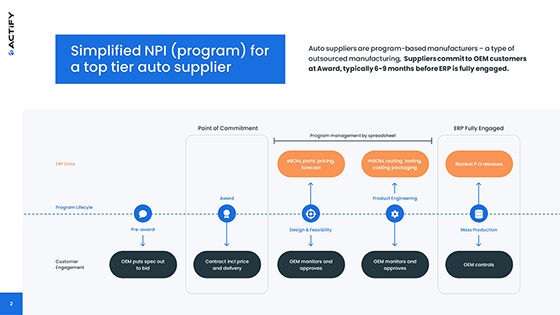

The development and production lifecycle of a platform/vehicle/model is known as a program. As automakers, often known as Original Equipment Manufacturers (OEMs) create new programs, they work with supplier community to source most of the systems and components that comprise a finished vehicle.

Suppliers compete to participate in programs, and if successful, are awarded long-term contracts for thousands, even millions of parts. That’s the good news. But auto suppliers face a combination of challenges that makes their situation unique and fraught with risk. There are two categories of supply contract. Both come with substantial risk:

Build-to-print

The OEM provides the design and specifications for the components for which the supplier must quickly develop a comprehensive bid detailing every facet of production, quality assurance, and pricing.

There may be several rounds of bidding before an award is finalized. Because the OEM controls the design, competing suppliers have limited options for differentiation. Suppliers stress their capability, quality, and reputation, but the OEM always has the upper hand, and competition is often reduced to price and terms. Winning often means committing to the risks inherent in high-volume, low-margin business.

That’s risky enough on its own, but consider that the program is still just a design in a CAD file at this stage in the lifecycle. The work of developing, testing, and launching the program into full-scale production has not yet started. Suppliers draw on their most experienced engineers to develop their bids, but the costs and timescales are all estimates. The supplier’s success depends on the accuracy of their bid, and there’s little room for error., The OEM will hold them to whatever pricing was agreed upfront and will exact heavy penalties if the program goes off track.

Full-service

The OEM provides specifications for the needed parts, or the supplier may propose new and innovative systems or components for the OEM to incorporate into a new model. Either way, the supplier is both designer and manufacturer of the system or component. As with a build-to-print contract, a comprehensive bid is developed, but a preliminary award is granted to authorize detailed design work, and then the OEM grants a final award once the design is accepted.

A full-service supplier has a closer relationship with its OEM customer, and often will be supplying a premium product with a more attractive profit profile. But a full-service contract adds to the degree of risk the supplier bears. For example, as the design authority for the part, the supplier may be responsible for all the costs involved in making an engineering change after the design has been finalized. And the more complex the product, system, or assembly, the more opportunities for problems to arise internally or with downstream tier suppliers.

The Automotive Program Lifecycle

Suppliers work with their existing OEM customers and with industry sources to anticipate future OEM component needs and bidding opportunities. Business development teams are responsible for soliciting Requests for Quotation (RFQs) from OEMs, and then managing the bidding process during which a supply program is defined, and a contract awarded. Actify calls this stage of the lifecycle Program Development.

The bidding takes place in rounds as the OEM narrows down its search to a single supplier. At each round, suppliers provide more information and more detail on how the part will be manufactured including the costs of materials and tooling. OEMs demand ‘transparency’ – they want to know how the contract will be executed in complete detail – and will hold the supplier to the specifics of their bid.

Typically, OEMs require a response within ten days, which means there is little time to digest engineering changes, understand the impact on internal and external costs, and compile the comprehensive bid package required. The lack of adequate time for due diligence means suppliers must draw on institutional knowledge and experience when preparing their bids.

Upon winning an award, the supplier enters a new multi-phase stage of the program lifecycle that Actify calls Program Management. This stage follows the outline of a typical APQP (Advanced Product Quality Planning) flow, but every supplier has their proprietary scheme, and often with variants for specific OEM customers and program types.

During the Program Management stage, the program advances through:

- Product Planning and Quality Program Definition.

- Product Design and Development.

- Process Design and Development.

- Validation of Product and Process.

- Production Launch, Assessment, and Improvement.

The Program Management team is responsible for coordinating the many internal and external stakeholders involved in taking the program from award to launch and into full-scale production. While they do not directly manage the extended team, program managers are responsible for on-time, on-budget performance.

During the many months from program concept to production there may be many design and engineering changes that occur, either initiated by the OEM or the supplier. Suppliers must track these changes and be able to explain via a “cost walk” the detailed cost variances that occurred. Additional costs are reimbursed only if fully documented and accepted by the OEM. Suppliers must also track all the expenses related to tooling built for specific programs. These tools are paid for by the OEM and are their assets, which suppliers must track and hold in inventory indefinitely on behalf of the OEM.

The program management team’s responsibility ends when the part is in full-scale production, typically 90 days after launch. At this point, plant management is in operational control and the program team re-engages only if the OEM requests an engineering change.

However, another important step remains. Each program has the potential to add to the organization’s institutional knowledge based on risks encountered, decisions made, improvements discovered, and outcomes achieved. After launch, program teams reflect on what they have learned and try to capture this knowledge for future teams to apply. Actify calls this Program Analysis and has discovered that, while it has great potential value, today suppliers do not have effective methods to capture and transfer lessons learned.

The Forgotten Team

There are software solutions for every flavor and every facet of manufacturing execution and yet the overwhelming majority of automotive suppliers have developed program management systems in-house due to an absence of suitable purpose-built products on the market.

Sometimes, IT departments adapt existing software like ERP, PLM, and CRM to support program management with limited success, but more often it is the program managers themselves that have evolved their own systems using off-the-shelf tools like project management software. However, the number one software used to support what are arguably the most critical operations an automotive supplier executes is far and away Microsoft Excel.

This is not by choice. Program managers do not want to be software developers, and they need enterprise software as much as their colleagues in engineering, plant management and sales, yet they are in effect the forgotten team from an IT industry perspective.

This is a problem that has persisted for decades, and program managers have learned to accept the status quo. They labor to keep up with an ever-growing portfolio of programs and ever-increasing demands from OEM customers. Their job is to keep programs on track and anticipate and resolve problems before they occur, but the sheer volume and pace of operations leaves them struggling to keep tabs on the extended team, manually record data updates, and respond to questions from customers and executives. Program managers end up reacting rather than looking ahead.

The Looming Crisis

While this is a long-running problem, industry trends suggest that it is about to become a crisis.

Escalating Program Volume

The movement toward electrification is driving program volume. New electric vehicle (EV) vendors are proliferating, creating new business opportunity for suppliers but thereby adding to the program management load. And the success of these vendors is causing a frenzy of activity among traditional internal combustion engine (ICE) vendors.

News that Tesla builds the fastest selling luxury sedan, and that Rivian builds the most capable off-road truck, makes ICE manufacturers realize that ten years is an unacceptably long time to launch competing products. In response, automakers around the world are accelerating their plans, fast-tracking new programs, and increasing launch tempo.

Supply Chain Woes

The global pandemic exposed the fragility of extended, lean supply chains. The manufacturing mantra of just-in-time manufacturing and low inventories is great when everything is working but can bring production to a standstill when supply chains are disrupted. Normally, supply problems are localized, and alternatives are available, but the pandemic hit everyone and everything at the same time. The impact on the auto industry is still evident, with labor shortages and disruptions to shipping and part availability driving price spikes and long lead times.

Building resilience into supply chains not only needs new thinking, but it also needs new investment and a more collaborative approach from OEMs to their suppliers. Yet so far, OEMs have shown little willingness to relent on existing program terms, and suppliers preparing new bids have insufficient data to support committing to future cost levels.

In this environment, suppliers need their program management function to scale to handle new volume, and to have the speed and agility to manage disruptions to supply. The spreadsheet-based systems and largely manual methods of data updating prevalent today simply cannot respond. They represent a vulnerability at the heart of the auto supply chain.

This Time of Change and Challenge

The auto industry has weathered many economic cycles, and suppliers are accustomed to the change that comes with continual improvement and innovation. But the future facing the industry today is different. These are seminal changes that bring with them both threats and opportunities. There will be winners for whom electrification represents expansion and growth. And there will be others who see demand for ICE components shrinking and must seek out new products or new markets to secure their futures.

For most the outcome is not yet clear, though merger and acquisition activity suggests that companies are thinking strategically.

However, we know for sure that times of change and challenge expose the weaknesses in systems and processes, and without a rapid response to the vulnerability inherent in current program management technology, suppliers are set up to fail.

The Automotive Program Management Manifesto

We at Actify have been working directly with program managers, business leaders, engineers, and IT professionals in the auto industry for more than 15 years. After countless conversations with both decision-makers and people in the trenches, we noticed several recurring themes.

We distilled these themes into the following six theses, which together form what we call the Automotive Program Management Manifesto.

These points are self-evident to those who have been managing programs for a long time.

-

The pressure on program managers is unsustainable.

-

Program managers are the key to regaining profits.

-

It is time to move on from spreadsheets.

-

Program teams need a single “system of reference.”

-

Enterprise-level clarity is the key to execution acceleration.

-

The solution must be purpose-built for the auto industry.

Actify can help

Automotive program management is the next frontier for top-tier supplier profitability. Forces in the auto manufacturing industry are contracting margins, but you can counter that trend by making the programs themselves less costly and time-consuming. The suppliers who can master the art of program optimization will thrive: Actify APM was built to help you do this.